- Product

- Pricing

- Affiliate Program

- Use Cases

- Resource

Arbitrage trading is a low-risk trading strategy that exploits price differences for the same asset across different markets. Traders simultaneously buy an asset in one market and sell it in another to lock in a profit.

Arbitrage opportunities often emerge for a few seconds. Traders using algorithmic and high-frequency systems can exploit these brief inefficiencies. For example, the Kimchi Premium in 2017 allowed crypto arbitrageurs to earn up to 30% by buying Bitcoin in the U.S. and selling in South Korea.

Unlike directional trading, arbitrage is independent of market trend. For example, in merger arbitrage, traders hedge market risk by going long on the target and short on the acquirer.

Arbitrage strategies can be applied in various domains:

Stocks (e.g., A/H-share arbitrage)

Cryptocurrency (e.g., exchange price differences)

Forex (triangular arbitrage)

Commodities (futures-spot price gaps)

Arbitrage trading helps correct mispricing in real time. For example, ETF arbitrage ensures that market price tracks the fund’s net asset value, especially during high volatility periods like the COVID-19 market crash.

Arbitrage assumes instant execution. In practice, thin markets may trap traders. For instance, in April 2020, U.S. oil futures dropped below zero and many arbitrage positions became unsellable.

Speed is everything. Technical glitches or delayed execution can eliminate profits or cause major losses. Knight Capital lost $460 million in 2012 due to a 0.001-second software error.

Arbitrage across borders faces legal constraints. Examples include:

China's capital controls affecting A/H arbitrage

India’s 2021 crypto ban disrupting Bitcoin trades

Regulatory blockages in mergers (e.g., NVIDIA–ARM)

Small arbitrage spreads are often wiped out by:

Trading fees and slippage

Stock borrow rates (especially in convertible arbitrage)

Currency conversion fees

Success in arbitrage requires more than spotting price gaps. It demands discipline, tools, and a methodical approach.

Start Small – Early trades should prioritize learning, not profit.

Learn from Others – Join trading communities or forums.

Use Demo Accounts – Practice with paper trading to refine timing.

Develop Pattern Recognition – With time, you'll spot mispricings instinctively.

To succeed in arbitrage trading, use the right technology:

Algorithmic trading platforms – Automate execution (e.g., Python bots)

Market monitoring tools – Track real-time pricing (e.g., TradingView)

Data analytics – Backtest strategies and build quantitative models

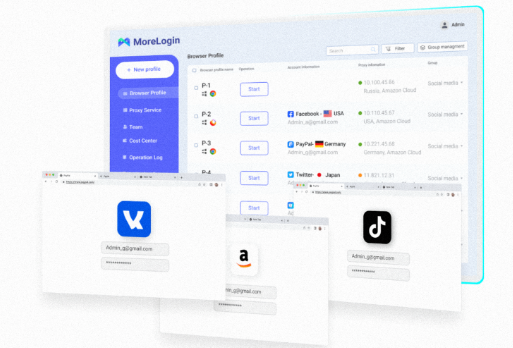

Account managers – Tools like MoreLogin support multi-account execution with speed and security

Arbitrage trading can be profitable but requires precision, discipline, and robust infrastructure. As global markets become faster and more efficient, successful arbitrage increasingly depends on automation, regulation awareness, and execution speed.

By starting small, learning proven strategies, and adopting tools like MoreLogin, traders can improve their edge and grow steadily in this competitive trading approach.