- Product

- Pricing

- Affiliate Program

- Use Cases

- Resource

What is arbitrage trading? Simply put, it is the simultaneous buying and selling of the same asset in different markets to profit from the price difference.

In today's rapidly changing financial markets, arbitrage trading is gaining increasing attention from investors.

In 2025, global financial markets will face a more liquid and competitive environment, which presents both new opportunities and challenges. So what are the trends in arbitrage trading for 2025? This article will explain the key trends in arbitrage trading and important strategies to watch. It will also introduce useful arbitrage tools. Finally, we'll discuss how to handle upcoming challenges.

The most significant change in financial markets in 2025 will be further improvements in liquidity and intensified competition. As more institutional investors enter the arbitrage trading field, the window for traditional arbitrage opportunities will continue to shrink. This requires traders to equip themselves with more advanced tools and faster execution capabilities.

The rapid development of stablecoins and decentralized finance (DeFi) will become a key battleground for arbitrage trading in 2025. Price differences between decentralized exchanges are often larger than those on traditional exchanges.

However, these arbitrage opportunities come with technical barriers, requiring proficiency in cross-chain bridges and MEV protection tools, as well as reliance on blockchain explorers and automated scripts for high-frequency arbitrage. For traders familiar with blockchain technology, this presents lucrative opportunities.

Additionally, due to the unique nature of DeFi markets, such arbitrage often demands deeper knowledge and stronger risk management skills.

The arbitrage potential in the non-fungible token (NFT) market should not be overlooked. Although the NFT market cooled down to some extent in 2023, data from 2024-2025 shows that short-term trading arbitrage for blue-chip NFTs (such as BAYC and CryptoPunks) still offers profit potential.

Research from Odaily Planet Daily found that buying and selling within short timeframes, particularly in 7-day and 15-day cycles, is most likely to yield positive returns.

Cross-platform arbitrage will remain one of the most mainstream arbitrage trading strategies in 2025. The core of this strategy lies in profiting from price differences of the same asset across different trading venues.

For example, Bitcoin often trades 1-2% higher on South Korean exchanges compared to other regions—a phenomenon known as the "Kimchi Premium." With more regional exchanges emerging in 2025, similar arbitrage opportunities may become even more diverse.

Triangular arbitrage holds unique advantages in the forex and cryptocurrency markets. This strategy involves cyclical trading among three currencies, locking in profits through precise exchange rate calculations. Although this method demands extremely fast execution speeds, individual investors can still participate in 2025 thanks to high-speed trading networks and trading bots.

Combining arbitrage with quantitative strategies will be an important direction for future development. By using mathematical models and algorithms, traders can quantify data to effectively identify price differences between markets and execute trades. This big data analysis approach helps uncover arbitrage opportunities that manual trading might miss, increasing profit potential for traders.

Additionally, advanced statistical methods can predict when arbitrage opportunities may emerge based on historical data, giving traders more time to react.

Good tools make arbitrage trading easier. They help traders find opportunities faster. Modern tools also reduce risks. Here are some key tools for 2025.

Tools like 3Commas enable fast cross-exchange trading. They identify price gaps and execute trades quickly. These bots operate 24/7 to capture opportunities humans might miss. Ideal for rapid arbitrage between markets, they streamline cross-platform transactions.

Platforms such as TradingView track real-time market prices across exchanges. They detect correlations and trends between assets, with minute-level data updates. Traders use them to test strategy effectiveness before live execution, making them valuable for trade planning.

Systems like RiskGuard provide round-the-clock trade monitoring. They trigger immediate alerts when risks exceed thresholds, particularly useful for leveraged trading. By enabling instant intervention, they prevent significant losses and mitigate sudden market risks effectively.

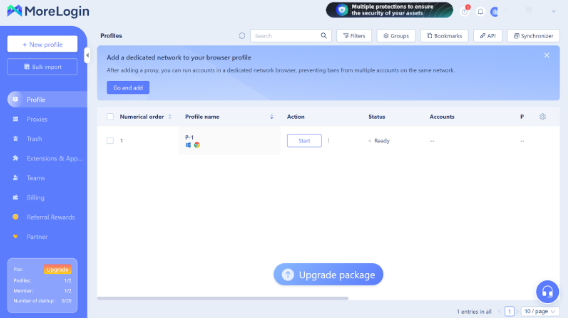

Multi-account software like Morelogin can significantly improve arbitrage trading operations. By managing multiple trading accounts and simplifying workflows, such tools allow traders to focus more on strategy rather than tedious daily operations. For traders active in various markets, these efficiency tools are almost indispensable.

For efficiency enhancement, here's an organized table for your reference.

1. Continuous Learning

Set aside 2 hours each week for focused learning. Subscribe to specialized newsletters like The Arbitrageur and follow financial news outlets, including CoinDesk and Bloomberg.

Attend monthly online workshops offered by major exchanges such as CME Group and Binance to stay current with trading technologies.

2. Tracking Global Developments

Establish systems to monitor geopolitical risks that may affect markets.

Carefully track economic indicators by noting release dates for important data like GDP and CPI figures.

Participate actively in trading forums to gain diverse perspectives on how world events impact financial markets.

3. Starting Small

Begin by testing strategies thoroughly using demo accounts.

Conduct detailed backtesting with historical market data to identify and correct weaknesses in your approach.

When ready, transition to live trading with carefully limited position sizes to manage risk effectively.

Arbitrage trading in 2025 will present both opportunities and challenges. On one hand, improved market efficiency may shrink traditional arbitrage margins. On the other hand, new markets and tools will create fresh opportunities. The key to success lies in staying updated with the latest trends, flexibly applying various strategies, and leveraging advanced trading tools.

Whether it's high-speed trading bots or intelligent analytics systems, these technological assets will become core competitive advantages for arbitrage traders. Investors are advised to start exploring and testing these tools now to prepare for the evolving market landscape in the future.