- Product

- Pricing

- Affiliate Program

- Use Cases

- Resource

YouTube, Telegram channels and game chats are overflowing with ads for crypto bots and NFT projects. If you spend an hour or two there, you’ll come across dozens of such integrations. Today we will dive deeper into: why projects are willing to pay for such traffic, who is behind the distribution, what income it brings, what specifics exist across different regions — and most importantly, how one can earn up to 30 % commission as a middleman in this market.

Short clips with crypto‑stickers — essentially Reels and TikToks where promo tags of an exchange or project are overlaid unobtrusively. This works like a “25th frame”: the brand flashes dozens of times per clip and sticks in the user’s mind. Such formats collect large reach: similar videos can amass up to 200 million views per month — which averages to several impressions per active user.

When a crypto product enters a new GEO, it faces distrust: users don’t know the brand, fear a scam, hesitate to commit large sums — this naturally cuts LTV and directly impacts profitability.

That’s why the product needs to quickly build media presence and show that the brand is everywhere. Unlike influencer buys or targeted ads with high CPM, sticker integrations offer predictable pricing per impression and allow mass scaling. Entry threshold is reasonable: ~$5–10 k is enough to test a niche and see effects — growth in organic traffic, appearance of branded searches, increase in average deposit.

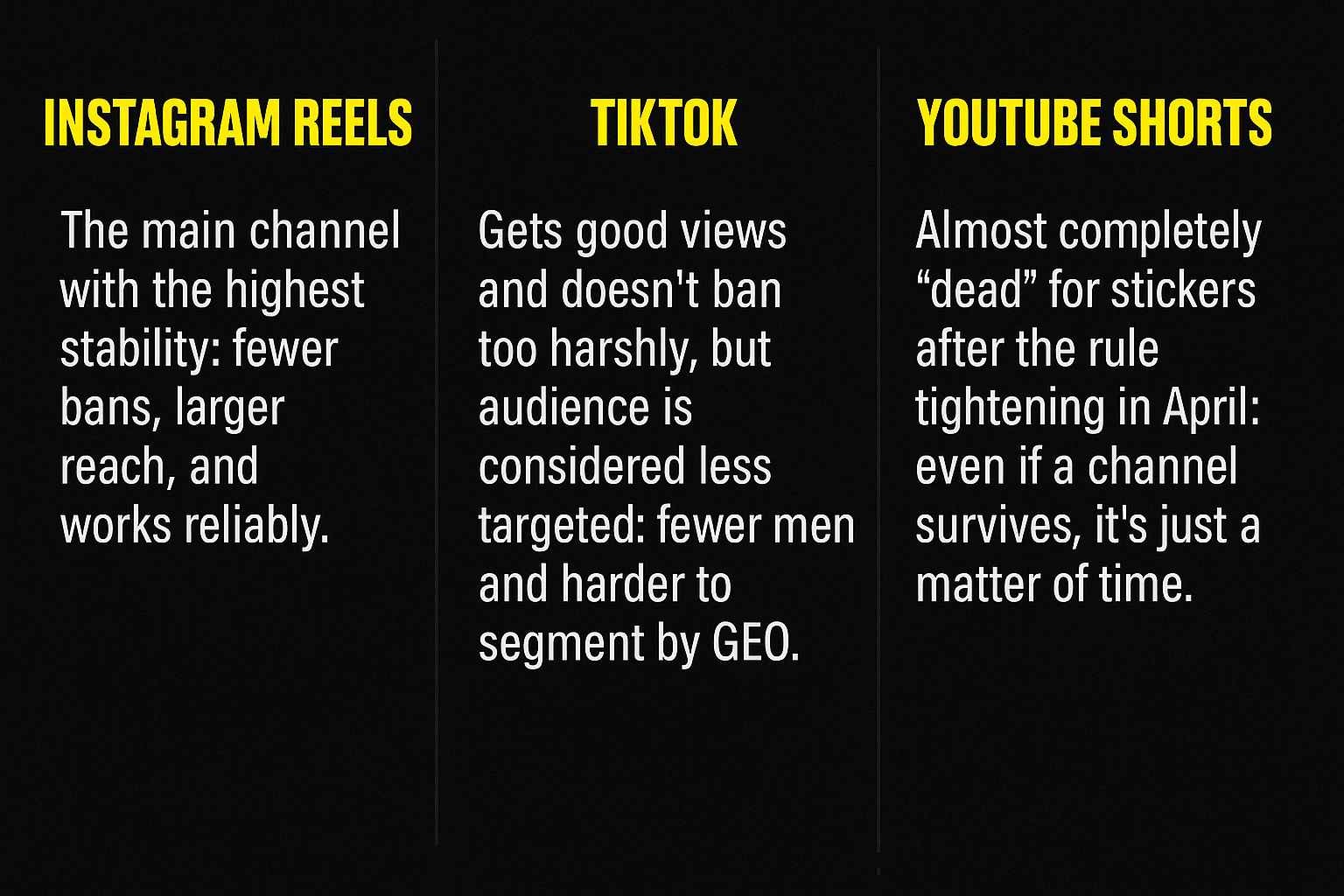

In UBT sticker campaigns the most common model is CPM (cost per thousand impressions) — payment for a thousand or million views. The only difference lies in payout terms: post‑payment or prepayment.

Post‑payment typically occurs when exchanges and funds deal directly with channel owners or arbitrage teams. The scheme is simple: run the impressions first, then advertiser verifies quality, then payments. Safe for advertiser but riskier for performers: delays or full payment refusal may occur.

Prepayment is used when working via agencies or media buying teams. Crypto products don’t want to individually vet channels and monitor performers, so they hire a contractor. Money is reserved in advance as payment guarantee, and the agency takes a commission — usually around 20–30%. For example: if CPM in Turkey is $500 per million views, the agency earns an additional $100–150. With volumes of 50 million views that’s already $5–7.5 k in commission.

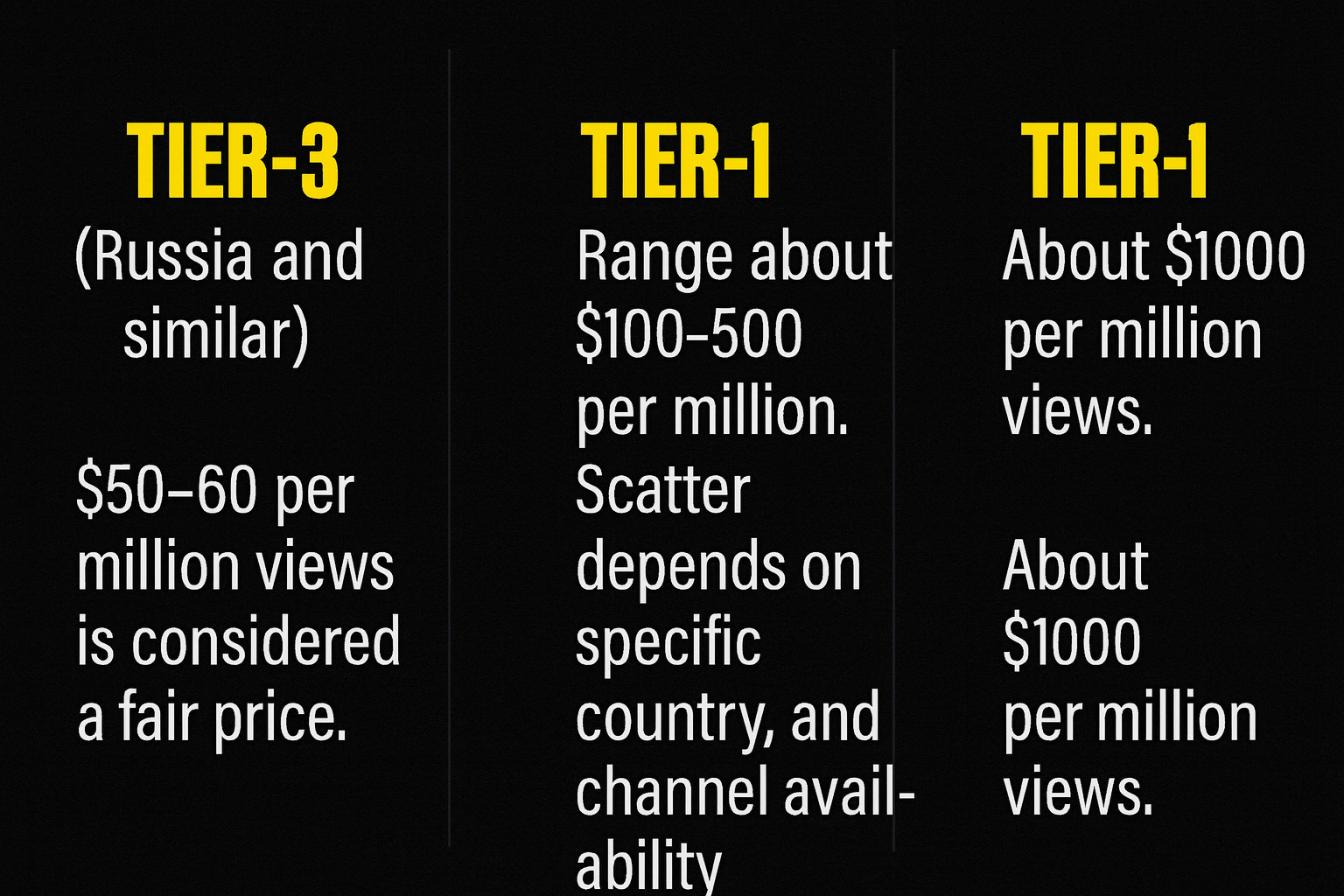

Cost and effectiveness depend heavily on GEO and platform specifics. The more solvent the audience and the harder the launch, the higher the price and stricter the channel admin demands.

Russia: Easy to get volume — many channels and public groups, uploads pass without major hurdles. But competition is huge → rates drop and it becomes a race for speed.

USA and Canada: Few channels, strict requirements for crypto sticker ads due to regulatory risk. CPM is high but scaling is limited.

India and Southeast Asia: Low cost impressions, but poor quality traffic: many ⟮“grey”⟯ channels that treat this format like spam; many times auctions don’t convert as expected. Despite cheap CPM, collecting working volume is hard.

Europe: Less competition than CIS, but organizational issues: channel admins may drag replies for weeks or change terms mid‑campaign.

For campaigns to reach massive views manual uploads aren’t enough. Thousands of videos daily are distributed via software. These tools are rarely public — built for specific teams. For small or new teams this isn’t relevant: when you’re talking tens of videos, manual editing and uploads suffice.

The sticker must be visible but not trigger platform algorithms into blocking. Usually it occupies no more than 20–25 % of the screen to not interfere with the video content. It’s also important not to place overlay elements over UI buttons or comment zones — such videos are more likely to get banned.

Best results come from long horizontal bars or centered rectangles — these formats are less likely to be flagged, maintain visibility and lead to higher transitions to landing pages or insert referral links (often in profile or pinned comment).

One case: “sticker with timer.” The video showed a countdown overlay then the ad sticker popped in. This created urgency, reduced ‘banner blindness’ and improved CTR. In short: you need to balance design to be memorable and intriguing, yet compliant with platform rules and safe from bans.

Advertisers need to verify that work is actually being done, not simulated. Teams log all uploaded videos, number of views, clicks, registrations, deposits. These data are shared in reports. The client can at any moment open any uploaded video, check view count and confirm there’s no artificial boosting. This transparency is a key selling point for the teams.

Don’t just rely on uploads. It’s important to motivate channel admins for extra steps: pin a referral link in profile, post in Stories, post promo‑codes. This significantly boosts conversion. Advanced teams use bots and auto‑funnels to warm audiences and drive them to deposit. That immediately sets them apart from competitors who only sell “dry impressions”.

Important metrics: track view gains by new videos week‑to‑week, not just overall growth of one video. Often there’s a “rollover”: e.g. paid for 40 million impressions, final reach is 45 million — extra views go in favour of the client. Key system elements: post‑backs, unique referral link and access to the affiliate program. If one of these is missing, at least request client reports regularly to cross‑check data.

A minimal setup to launch includes three roles:

Media Buyer: finds platforms, negotiates with admins, buys impressions. On start from ~$400–500 for junior to ~$1.5–2k for mid‑level.

Project Manager: monitors process — ensures budget flows, view data isn’t faked, KPI met.

BD (Business Development): sells services to crypto products, handles objections, builds trust.

Video creation cost per clip varies ~$1 to $100 depending on complexity — but inside the team this KPI is rarely counted separately; result is measured by purchased CPM and total view volume.