- Product

- Pricing

- Affiliate Program

- Use Cases

- Resource

The profits of Crypto come out of smart strategies.

We all know that Cryptocurrency trade is a high-risk, high-rewarding activity. On the crucial battlefield, one miståake could cost you years of work and make you lose everything.

However, over the years, there are still countless people who are constantly making more and more money in the market, despite how unstable the market has been. The secret to success, you ask?

A smart strategy.

So today in this article, we will explore 4 crypto trading strategies that have been used in the past by successful traders. Learn these strategies and apply them to your daily trading activities, and I'm sure that you will earn more than you used to.

The two-account crypto strategy involves having two different accounts for different purposes. One account is for long-term investments, where you buy and hold cryptocurrencies for years or even decades. The second account is for short-term trading or scalping, where you buy and sell cryptocurrencies quickly to make quick profits.

By having both a long-term and a short-term account, you can balance your risk and maximize your profits. Specifically, you can take advantage of the long-term potential while also taking advantage of short-term market movements to potentially make quick profits.

However, one of the challenges of implementing the two-account crypto strategy is platform restrictions. Many cryptocurrency exchanges have strict rules and regulations that limit the number of accounts a user can create. These rules are in place to prevent users from engaging in fraudulent activities, such as money laundering or market manipulation.

To avoid the complexity of dealing with the regulation and apply the 2-account strategy, using an anti-detect browser when registering and operating your additional crypto accounts is essential.

A good anti-detect browser, like MoreLogin, can protect your online privacy by masking your online activity, making it more difficult for the crypto trading platform to identify you as having multiple accounts.

MoreLogin uses advanced techniques such as changing IP addresses, dynamic browser fingerprints, and other identifying information to create a unique profile for each of your accounts. With this anti-detect browser, you can not only operate multiple crypto accounts on one device, but also do the same with social media platforms and allow you to manage multiple social media accounts on Facebook, Tiktok, and more platforms without being detected as having multiple accounts.

If you want to create and operate your additional crypto accounts with MoreLogin, here is a simple guide showing you how to do it:

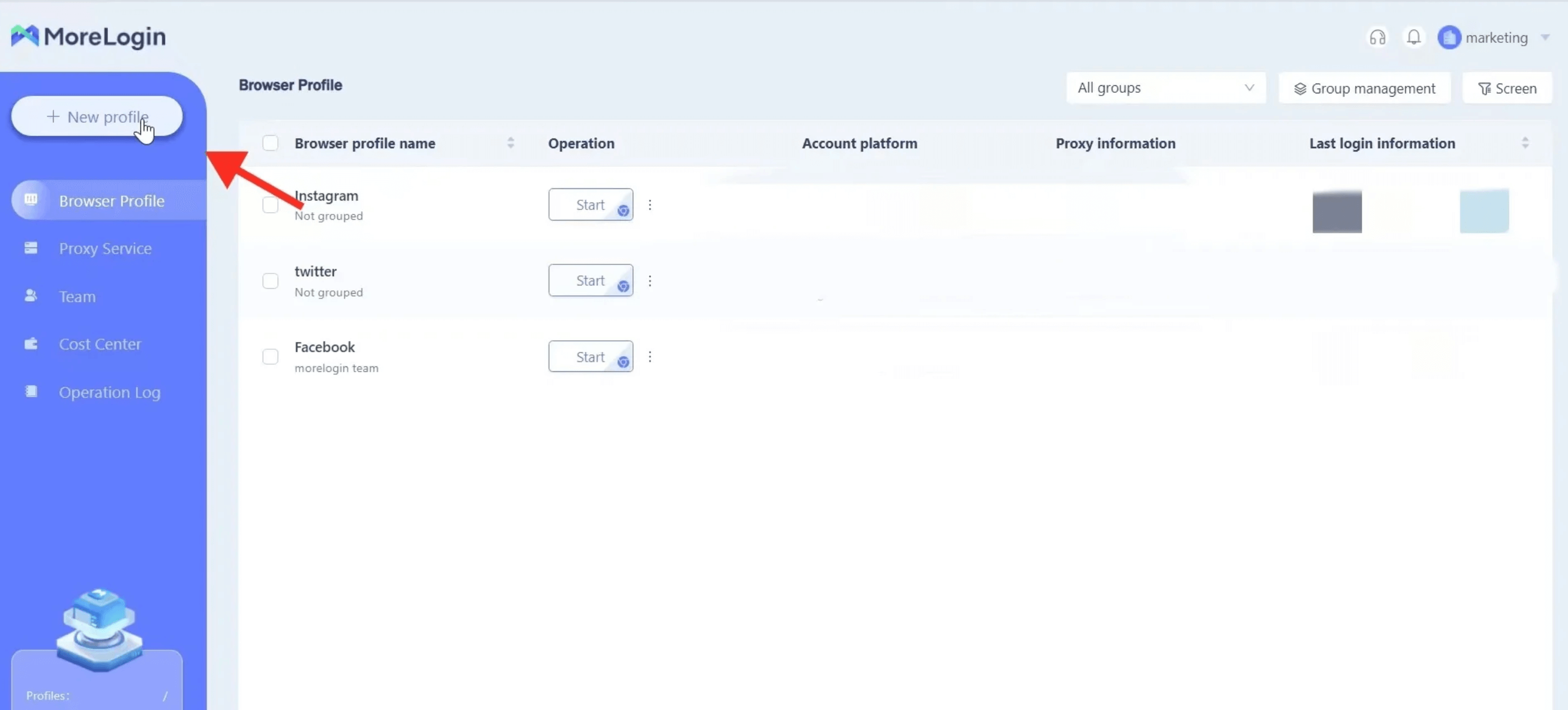

Step 1: Register for a MoreLogin account and download the MoreLogin anti-detection browser from its official website.

Step 2: Log in with your registered MoreLogin account in the client. On the home page of the program interface, you will see a “New Profile" button at the top left corner. Click on it and complete the settings inside to create a unique browser profile for your additional crypto accounts.

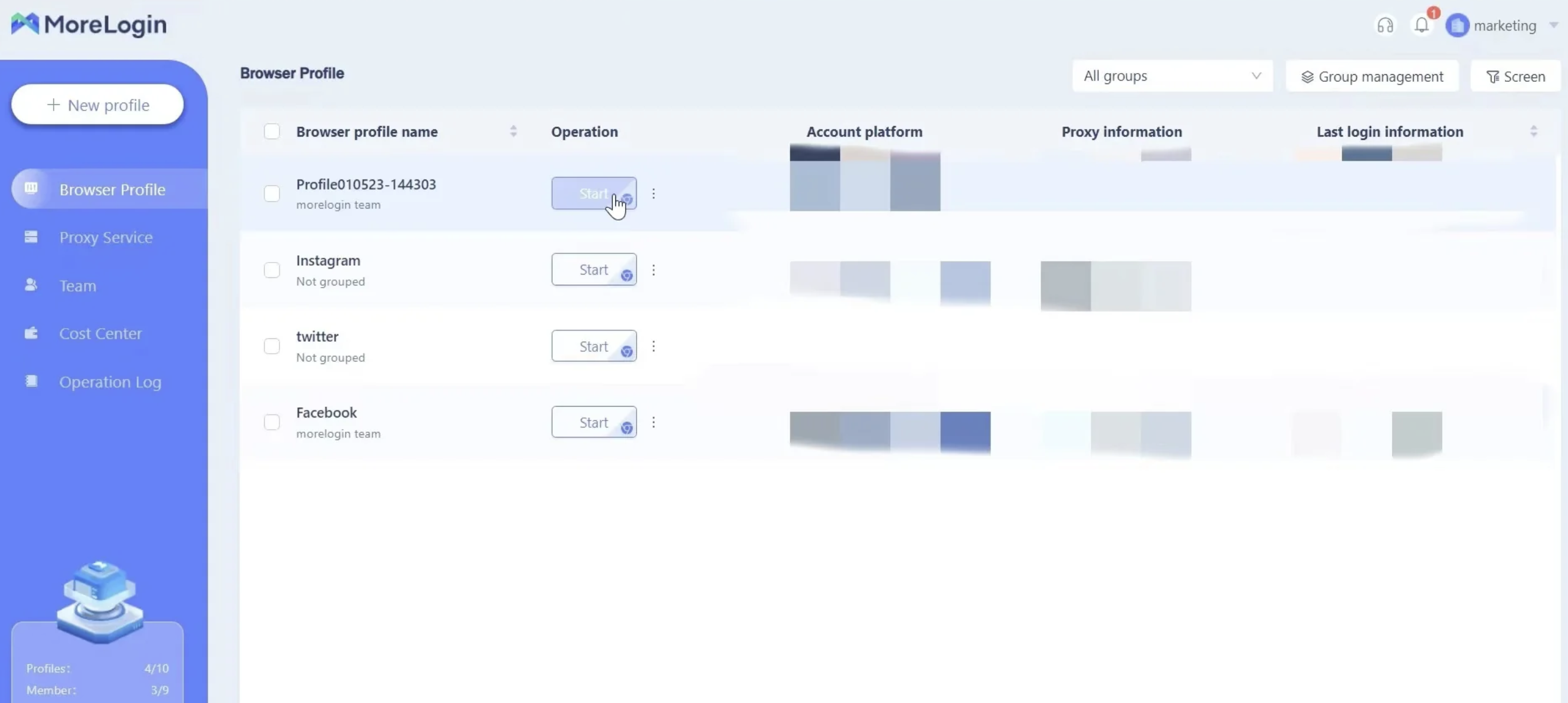

Step 3: Finally, go back to the “Browser Profile” page and find the newly created profile. Then click "Start" to wake up a fully customized browser window. You can now create your new cryptocurrency account in this window without being detected as having multiple accounts.

The second strategy is researching smaller coins and understanding when these ecosystems are about to grow. Usually, there will be an identifiable point when an ecosystem is about to grow, and it's called an “incentive scheme” or “incentive plan” that large VC-backed chains implement.

These incentive schemes are used time and time again by venture capital investors to bootstrap growth and get users to their blockchain. If you know when this is happening, you can take advantage of it and make profitable trades.

For example, on August 18, 2021, Avalanche went through the first round of incentive programs called “Avalanche Rush”. They were giving away $180 million to people who would put their money onto the blockchain and start using some applications. If you had bought any time around here knowing that the money was going to come onto the system, you would have bought at $14-$16. Then, when the incentive program hit, the price skyrocketed to $150. This is a prime example of how you can make successful trades by understanding when incentive programs are coming.

This strategy is a risky but effective trading strategy. So it’s not meant for any beginners to go with this strategy because you might lack the experience to master it.

However, if you have been actively trading for at least months, this strategy may help you to gain more.

The strategy involves taking an opposite position in the market. that means when there is a lot of hype surrounding a project, you should know that the market is near its top and it’s time for you to short it because when retail traders start pumping the price up, it would be a sign that the narrative cannot last more than a few weeks at most, and the money starts coming out.

This strategy is riskier than most because it involves shorting at an all-time high. However, it is a profitable strategy when executed correctly. Short-term traders often go long at the all-time high, thinking that they will ride the market to a new all-time high. However, they often place their stop losses around the previous all-time highs, which coincides with the key level. When they realize that the market is not moving as they expected, they start selling, leading to a sell-off. As a counter trader, you will put a short trade in here, wait for the stop losses to get triggered, and buy back the cryptocurrency at a lower price.

The riding the wave strategy is a simple but effective strategy that involves technical analysis of a larger coin and riding the waves of a clear trend. To execute this strategy, you need to analyze charts to identify a clear trend in the market, such as an uptrend or a downtrend, then you buy or sell the trend depending on the trend.

For this strategy to work, it’s important to identify the support and resistance levels in the market. In case you didn’t know, the support level is the price level where the demand for the cryptocurrency is strong enough to prevent the price from falling further, and the resistance level is the opposite, where the supply of the cryptocurrency is strong enough to keep the price down.

In the execution of this strategy, you should use technical indicators like moving averages, Relative Strength Index (RSI), and Bollinger Bands to confirm the trend and identify the entry and exit points. It’s also important to manage your risk by setting stop losses to protect your capital.

Now that we have covered all 4 strategies, it is also important to note that a correct mindset is just as important as your strategies in cryptocurrency trading.

So at the end of the article, I also want to emphasize some mindsets to make sure that you can keep your head straight in the trading process.

The first, as well as the “crypto trading 101” in my opinion, is to focus on both fundamentals and technicals. Many traders will show you charts and technical analysis, which is great. However, fundamentals are the key to making much larger gains over a longer period of time. Therefore, it is essential to research the underlying technology and market potential of the cryptocurrency you are considering.

The next thing to keep in mind is that if you are a beginner, it is best to focus on one of these strategies and not try to implement all three at once. This can be confusing and increase the likelihood of making mistakes. Additionally, the 4 strategies have different risk and reward ratios. Some are longer-term and more conservative, while others are riskier and more short-term. It is important to choose the strategy that is right for you and your risk tolerance.

A smart strategy is crucial in crypto trading. All 4 strategies we introduced today are proven to work as long as you have the necessary skills and enough understanding of the market.

Among all 4 strategies, the first one, having two crypto accounts, is the most important one in my opinion, and it’s also a strategy that I think everyone should take, no matter if you are a beginner or an experienced trader. By having both a long-term and a short-term account, you can balance your risk and take advantage of both the long-term potential and short-term market movements to potentially make quick profits.

To overcome the platform restriction that often limits the number of accounts you can create, it's essential to use an anti-detect browser like MoreLogin. By doing so, you can operate multiple crypto accounts on one device without being detected as having multiple accounts. With the right strategy and tools, I’m sure you can navigate the crypto market successfully and make profits in the long run.