- Product

- Pricing

- Affiliate Program

- Use Cases

- Resource

The U.S. nutraceuticals market is one of the largest and most profitable segments in e-commerce. It generates billions in annual turnover, and consumer interest in vitamins, supplements, and wellness products keeps growing. Americans actively buy nutraceuticals online, and the main platform for these purchases is Amazon — from the first search to checkout.

It’s often said that nutraceutical brands are “born” on Amazon and can scale to multi-million-dollar businesses within 2–3 years. Thanks to Amazon’s infrastructure, smart positioning, and quality products, brands in this niche gain access to a massive audience and scale without traditional retail.

For affiliate marketers and media buyers from the CIS, U.S. nutraceuticals look especially attractive. Several successful agencies are already building consistent traffic funnels in this market. But transitioning from grey-hat models to a legitimate business brings new challenges:

Intense competition among brands

Strict regulation by the FDA

Major investments required in marketing, logistics, and product development

This guide explains how the U.S. nutraceuticals market works, why it's one of the most stable and profitable e-commerce sectors, and how Amazon plays a central role in scaling nutraceuticals.

American consumers trust Amazon as a quality benchmark: reviews, ratings, Prime delivery, and a simple return system create strong loyalty. For many buyers, a brand being listed on Amazon already signals trustworthiness.

Amazon’s ecosystem is built to convert one-time buyers into long-term customers with high lifetime value (LTV). A key driver is the “Subscribe & Save” model — a user buys probiotics or vitamins once, and then pays automatically every month. From a DTC and affiliate perspective, this is ideal: minimal effort for the first sale, maximum long-term return.

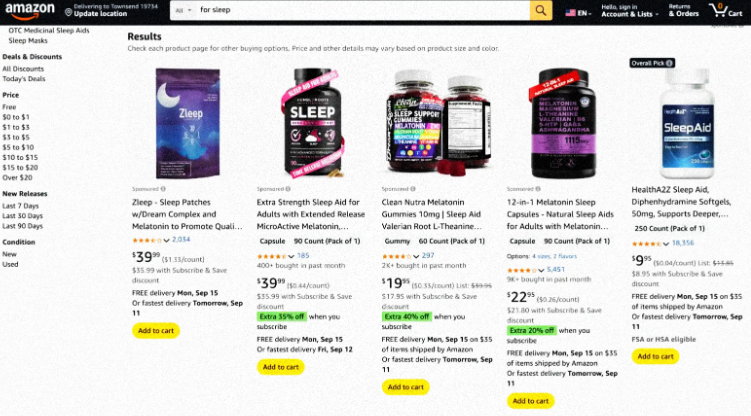

The nutraceuticals category on Amazon is saturated — thousands of brands compete for consumer attention. The range spans from giants like Nature Made and Garden of Life to DTC startups launched by small teams. Competition is fierce, but the market remains open. American buyers are eager to try new products if they align with their values: organic, sugar-free, plant-based, sleep support, stress management, and so on.

Today, the most effective market entries target narrow micro-segments: women’s health, adaptogens, CBD, focus-enhancing supplements. These niches allow smaller teams to build traction quickly while avoiding head-to-head competition with large players. With the right product listing, review acquisition, and Amazon ad campaigns, it's possible to reach seven-figure revenue within 1–2 years.

To succeed, the product must be clean and fully compliant with FDA requirements. The U.S. nutraceuticals market operates under the DSHEA law, which sets the ground rules for supplement production and sales. A few key points:

The packaging must meet strict criteria: correct ingredient listings, dosage, warnings, DSHEA disclaimer, manufacturer contact info, and a valid U.S. address. Labeling mistakes can result in FDA penalties or Amazon listing removals.

Supplements must be produced in facilities certified under cGMP (21 CFR Part 111). This certification ensures the product is safe, clean, and consistent in composition — not a formality.

If the product contains ingredients not previously sold in the U.S., the brand must submit an NDI notification to the FDA before launch. Failure to do so can lead to fines or product recalls.

If production is outsourced, the contract manufacturer typically ensures GMP compliance. But final responsibility for labeling and product positioning rests with the brand owner.

On top of FDA rules, Amazon adds another layer of compliance. Brands must provide full documentation: COA (Certificate of Analysis), DSHEA disclaimers, and strictly follow Amazon’s content policy. Any disease-treatment or weight-loss claims can lead to an instant listing ban with no recovery.

Because of this, most serious nutraceutical sellers work with legal consultants to review product labels, listings, and ad creatives for compliance.

To further protect the listing, brands register with Amazon Brand Registry. This unlocks A+ content, videos, Vine review programs, and most importantly — prevents hijackers from attaching unauthorized products to your listing. Without this registration, Amazon treats the brand as “unprotected.”

Launching a CPA nutraceutical product on Amazon means paying not just the 15% Amazon commission but also aggressively investing in PPC ads from day one. The goal is simple — drive organic rankings. Amazon’s algorithm rewards listings with strong sales velocity, CTR, and conversions. That means the first few weeks of campaigns are about “burning budget,” not ROI. Return on investment comes later — from organic traffic and repeat orders.

TikTok delivers viral reach, emotional engagement, and fast creative testing. Micro-influencer UGC (user-generated content) works best: “my morning with vitamins,” “what’s in my gym bag,” or “evening routine without stress.”

TikTok builds trust. In the supplement space — where consumers are sensitive to recommendations — organic, lifestyle videos boost confidence and directly convert into Amazon sales. UGC costs range from $3–5K per video, but often outperform traditional ads in ROI.

Advanced teams partner with agencies that manage influencer networks and run structured creative tests. To safely run multiple TikTok accounts and avoid bans, teams use tools like MoreLogin.

Top-performing Amazon brands don’t just have the best graphics — they excel at metrics, ads, and compliance. What do successful sellers have in common?

A product solving a clear need: not just “vitamins,” but “women’s probiotics,” “sleep gummies,” “greens for Gen Z”

Strong visual branding: infographics, lifestyle photos, videos, A+ content

Aggressive launch: 28-day PPC push with auto/manual campaigns, ASIN targeting

External traffic: TikTok hooks, UGC, and low CPMs

Operational discipline: inventory levels, COA docs, review monitoring, Subscribe & Save setup

SKU expansion around a core: new flavors, delivery formats, cross-sells

If budget is limited, some sellers drive COD traffic to Poland or other GEOs. But if you aim to build a long-term business in the world’s largest nutraceutical market, Amazon gives you every tool to do it — as long as you’re ready to play the long game.