- Product

- Pricing

- Affiliate Program

- Use Cases

- Resource

Arbitrage plays a key role in financial markets, creating profit opportunities while ensuring price efficiency. But what is the arbitrage exactly? Is it truly a risk-free way to make money? This article explores the definition of arbitrage, its types, advantages, limitations, the tools that enable this trading strategy, and future trends.

In financial markets, arbitrage is a trading strategy that exploits price discrepancies to generate a profit. Traders capitalize on discrepancies across different markets or at different times in the same market.

For example, if Bitcoin is priced at $30,000 on Exchange A and $30,200 on Exchange B, a trader can buy on A and sell on B, earning a $200 profit per Bitcoin (after fees). The core of this strategy lies in identifying temporary market inefficiencies and executing trades quickly to lock in gains.

While arbitrage is often considered a risk-free profit in theory, factors like market volatility, transaction costs, and execution speed impact actual results.

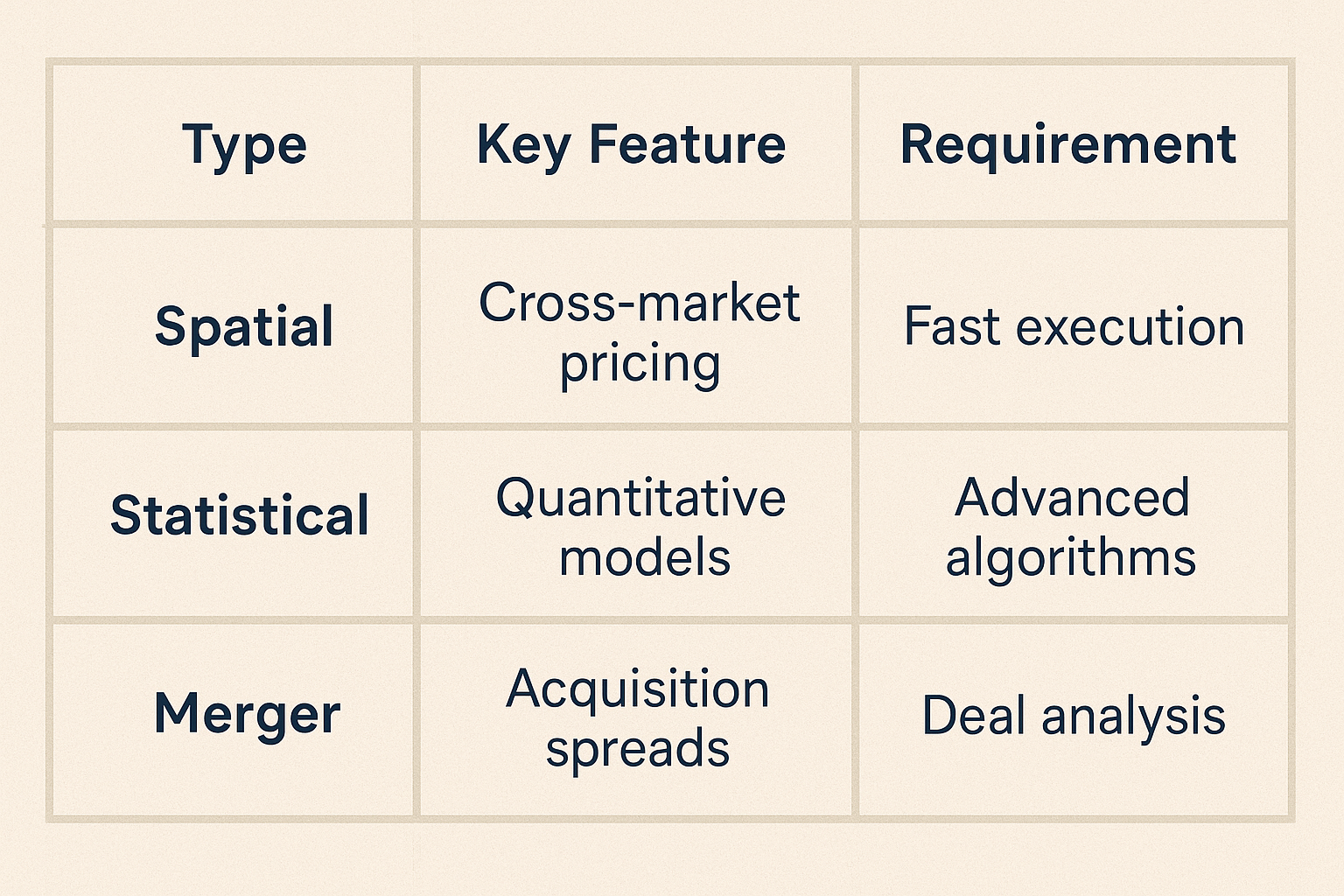

Arbitrage comes in various forms, each suited to different market conditions. The most common types include spatial arbitrage, statistical arbitrage, and merger arbitrage.

Spatial arbitrage, also known as cross-market arbitrage, is the simplest form. If a cryptocurrency trades at $100 on Exchange A and $105 on Exchange B, traders buy on A and sell on B to pocket the $5 difference. This strategy relies on price gaps between markets and requires fast execution before prices realign.

Statistical arbitrage is more complex, relying on mathematical models and historical data analysis. Algorithms identify correlated assets, such as Bitcoin and Ethereum, and execute trades when their price relationship deviates from historical norms. For example, if the price gap between them widens unusually, the algorithm may short the overpriced asset and long the underpriced one, profiting when the gap narrows.

Merger arbitrage occurs during corporate acquisitions. When a company announces a takeover, the target firm’s stock often trades below the offer price due to uncertainty about the deal’s completion. Traders buy the target stock, betting the price will rise to the acquisition value upon deal closure. When Microsoft announced its $196-per-share acquisition of LinkedIn, LinkedIn’s stock surged from $131 but remained below the offer price. Arbitrageurs profited by buying at the lower price and holding until the deal was finalized.

Many beginners wonder what arbitrage is. In simple words, it's simply buying low and selling high in different markets simultaneously. A common question is why is arbitrage illegal? Actually, most arbitrage is perfectly legal, but certain forms may be restricted when they involve market manipulation or insider information.

In fact, we can engage in arbitrage in many places. For those interested in e-commerce, what is arbitrage on Amazon? It involves buying products from other retailers at lower prices to resell on Amazon, a strategy that tools like MoreLogin can help manage efficiently through secure multi-account management. This approach is similar to advertising arbitrage, where marketers leverage cost differences in digital ad spaces.

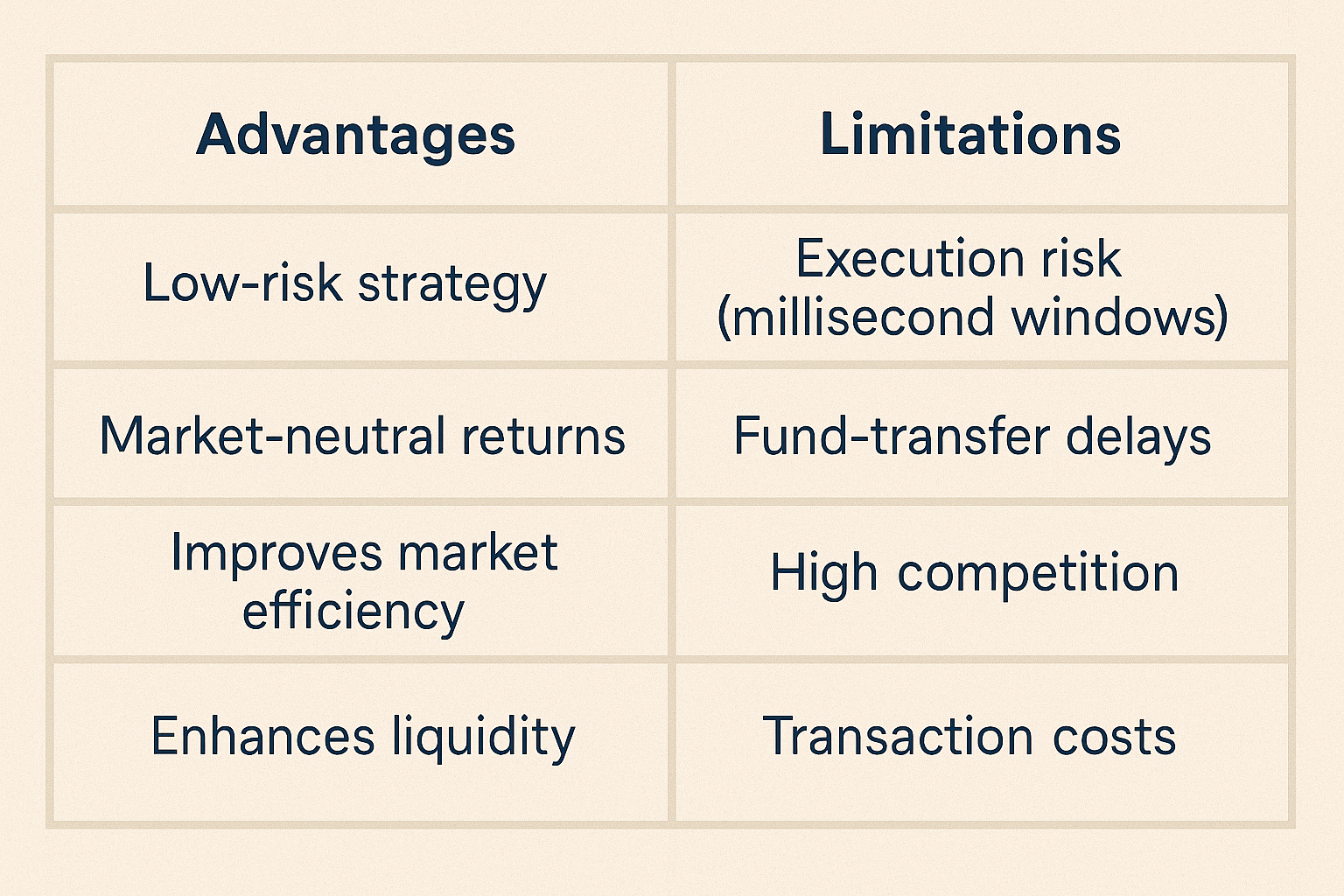

At first glance, arbitrage seems like a surefire way to profit. But is it truly risk-free?

The primary advantage of arbitrage is its relatively low-risk nature. Since it exploits price differences rather than market direction, it can generate steady returns even during volatility. This makes it an effective hedge against market risks.

Arbitrage enhances market efficiency. By capitalizing on price discrepancies, arbitrageurs help align prices across markets, improving overall pricing accuracy. Their trading activity also boosts liquidity, enabling smoother transactions for all market participants.

Despite its benefits, arbitrage faces significant challenges.

Execution risk is the most pressing because opportunities vanish in milliseconds, especially in today’s high-frequency trading environment. Delays of even a few milliseconds can erase profits.

Cross-market arbitrage also suffers from fund-transfer delays. In crypto, for instance, blockchain congestion can slow transfers between exchanges, causing missed opportunities. High transaction fees further eat into profits.

Merger arbitrage carries deal-completion risks. If a merger fails due to regulatory hurdles or other issues, the target stock may plummet, leading to losses.

Competition is another hurdle. Institutional traders with advanced algorithms dominate arbitrage, leaving little room for individual investors. Regulatory changes, like cross-border capital controls, add compliance costs and operational barriers.

Given these limitations, can I make money with arbitrage? Yes, but it requires sophisticated tools and fast execution.

Modern arbitrage relies heavily on technology. Algorithmic trading (Algo Trading) scans multiple markets in real time and executes trades at lightning speed. High-frequency trading (HFT) firms use ultra-low-latency systems to exploit tiny price gaps, amassing profits through volume.

For algorithmic trading, tools like MetaTrader and QuantConnect allow traders to automate strategies based on predefined rules. These platforms analyze live data and execute orders without human intervention.

For HFT, specific technologies like FPGA chips and microwave networks reduce data transmission delays. HFT firms such as Jump Trading and Citadel Securities use these tools to trade millions of times per day. They profit from small price differences across global markets.

Managing multiple accounts is crucial for cross-platform arbitrage, making account tools indispensable. MoreLogin allows secure multi-exchange logins on a single device, eliminating inefficiencies from frequent switching. Its isolated browser environments and IP configurations ensure both convenience and security, ideal for synchronized arbitrage trading.

Artificial intelligence (AI) and machine learning are revolutionizing arbitrage. AI analyzes vast datasets to spot subtle price patterns and optimize strategies. Deep learning models can predict liquidity shifts, enabling preemptive positioning.

Another trend is decentralized finance (DeFi). Automated market makers (AMMs) on DeFi platforms often exhibit pricing inefficiencies, creating arbitrage openings. However, the high costs and smart contract risks necessitate robust risk management by arbitrageurs.

Arbitrage profits from market price differences but faces challenges like execution costs, competition, and regulation. Success requires speed, advanced tools, and deep market insight. As technology evolves, arbitrage will continue to adapt, offering new opportunities. Tools like MoreLogin provide crucial support for traders looking to execute complex arbitrage strategies across multiple platforms securely and efficiently. If you’re interested, start with simulated trading to grasp what is the meaning of arbitrage and refine your approach for better results.